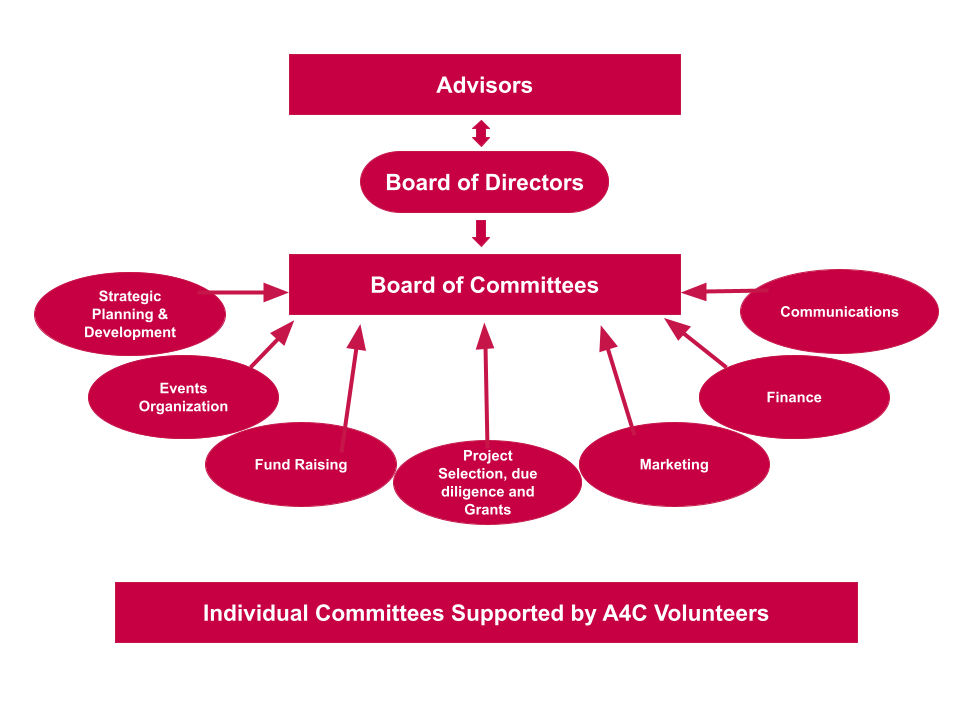

Organisational structure

A4C Executive Directors

Role/responsibilities of the Board of Directors: “het bestuur”. They act as a go-between the sponsors, the volunteers, the projects of choice, and other stakeholders. They are the legal signatories and have financial responsibilities of the accounts. They are responsible for the overall management of the charity and direction and ensure that A4C is following the correct strategic direction.

Marjolijn Breeuwer

Marjolijn Breeuwer holds MA Law from Radboud University Nijmegen (1998) and a BA Economics from Amsterdam University of Applied Sciences (1996).

She started her career as fund analyst and portfolio manager at Bank Insinger de Beaufort in 1998. In 2010 she became Head of Discretionary Portfolio Management at Insinger, at the time part of BNP Paribas Wealth Management. Following the merger of Insinger de Beaufort and Theodoor Gilissen in 2017 she was appointed Head of Investment Management. Marjolijn is a member of the senior leadership team within the Chief Investment Office at Quintet Private Bank. and a member of the Country Management Committee at InsingerGilissen.

Marjolijn joined Alternatives 4 Children since late 2020 as part of the Projects Team. She is married, has three children and lives in Overveen.

Marc de Kloe

Marc is Partner at Theta Capital Management.

He was previously Managing Director at Adamas Asset Management, an Asian based alternative asset manager and responsible for the Global Alternatives and Funds team for ABN AMRO Private Banking. He has a background in law and asset management, with over 20 years of investment experience including business development, fund management, legal, due diligence, selection, structuring, investments and ultimately sales. Marc has an LLB in English and German Law, from the University of Kent, an LLM in European Business Law from the University of Amsterdam and an MBA from Vlerick Business School. Marc is Dutch and has lived in Germany, France, Belgium and Luxembourg before moving to The Netherlands in 2007. Marc has two sons and is a co-founder of A4C.

Valérie Reinhold

Valérie holds a Master in Management from HEC Paris, a Bachelor in Modern & Contemporary Art Market, a Master in Art History and passed the Chartered Alternative Investment Analyst (CAIA) in 2009.

Valérie joined Theta in 2021 as Risk, Compliance & Special Projects Manager. Valérie began her career as an auditor in 2001 with KPMG, in Zurich and worked the following 10 years in the asset management industry in different roles including audit, fund administration, due diligence, business development and investor relations at Citco Fund Services. In 2012 she switched to the art sector to offer high quality services to collectors and institutions as an art advisor. Until 2021 Valérie also worked for an Art Summit in Switzerland as Operation & Development Director.

Valérie is married, has three children and is a co-founder of A4C.

Peter Vermeulen

Peter Vermeulen attended the University of Groningen (the Netherlands) and obtained a M.Sc. in Finance in 2007.

He is co-founder & advisor of Plethora Private Equity, an investment fund that incubates companies exploring for both precious metals and metals needed for the worldwide energy transition, such as nickel and copper.

Peter is also co-founder & advisor of Plethora Precious Metals, an investment fund focused on listed junior exploration companies.

He has been an active volunteer of Alternatives 4 Children since early 2021 and is part of the project team. Peter is married and lives in Utrecht.

Advisors

The role of the Advisors is to give informal guidance on our activities, for instance on providing valuable contacts and insight to the organisation. We currently have the following advisors:

Remco Bleijs

Chairman Alternative Investments Group EY The Netherlands and Chairman of the Financial Services Sustainability Services Group of EY The Netherlands.

Remco Bleijs is an assurance and advisory executive director in the Financial Services practice of EY in the Netherlands. He started his career at EY in 1988. He graduated as CPA in 1999. Since 2007 Remco leads the Alternative Investment Group in the Netherlands. In 2011 he became member of the management board of the Asset Management Group in the Netherlands. In the same year Remco became responsible for the Sustainability activities of the Financial Services practice. His clients includes some of the largest Asset Managers and other financial institutions in the Netherlands and several Alternative Investment managers and service providers in the Netherlands, BBC islands, Switzerland, London and New York.

Hilde Klok

Director – Koornzaayer Foundation.

Hilde Klok developed expertise in the field health care and education in developing countries and grant-making while working as a director at the Koornzaayer Foundation trust fund. Before that she worked for an international company providing integrated solutions for the care of people with reduced mobility and related conditions. Hilde is a board member of Ariadne a European network of philanthropist inhuman rights and social change. She recently has started her own company in advising other trust funds on their strategic planning.

Niels Oostenbrug

Institutional Business Development, Amundi Nederland

Prior to joining Amundi, Niels worked for MN, the fiduciary manager for Dutch pension funds from 2002-2015. He held various positions in equity funds and hedge fund management of which his most recent position was Director Equities, Special Investments, and Hedge Funds, responsible for the selection of external funds and monitoring the internal asset management department. Previous to this, between 1996-2001, Niels worked with Fortis Bank as an asset manager dedicated to institutional investors, having started working in the financial sector as a bond trader at ABN Amro and IMC as an options trader. Niels holds a degree in Quantitative Business Economics from the Erasmus University of Rotterdam and a Master of Financial Analysis from the University of Amsterdam.

Ruud Hendriks

Various Directorships

Ruud Hendriks has been working in the fund management industry for over 30 years. In the course of his international career, Ruud has held senior roles at some of the most recognised names in the business. Currently Ruud Hendriks is: Senior advisor to Lombard Odier, Senior advisor to KKR, Nonexecutive Chairman of Man’s Institutional Department, President of Man Investments SGR S.p.A., Chairman of the advisory board at Financial Assets. Previously, Ruud worked for Goldman Sachs Asset Management which he joined in 2001 as managing director, becoming co-head of sales for Europe (excluding Germany and Austria), Middle East and Africa in 2006. Ruud retired from Goldman Sachs in 2009. Prior to joining GSAM, Ruud worked for Rodamco, the property fund of the Robeco Group, between 1980 and 1996. He was a member of the Rodamco Executive Board between 1991 to 1996. He then moved to become Senior Vice President, Global Head of Institutional Sales at Robeco.

Clayton Heijman

Founder and director of Privium Fund Management

Clayton obtained a degree as Master in Business Administration from Webster University, with an emphasis in marketing and management. After working for Kas-Bank and merchant bank MeesPierson he joined Goldman Sachs as an executive director in the Equity Finance & Prime Brokerage division from 1994. In 1998 he joined Fortis as a Managing Director to set up the Prime Fund Solutions activities. After leaving in 2006 he joined Credit Agricole-Calyon as a Managing Director. In 2008 he founded Privium Fund Management and Darwin Platform, a firm that provides start up support to new investment management initiatives and offers COO support. These activities are now provided for over 30 clients, from 5 different locations with an overall asset size of $ 3 Bn.

Sophie Robé

(co-founder of A4C)

Sophie is the founder of Phenix Capital, an impact investing advisory and consulting firm. She has been working in the asset management industry in different roles research, financial analysis and marketing and sales roles since 1997. She is a French citizen, mother of 2, and has lived in France, Germany and the UK, before moving to the Netherlands in 2004. She founded Phenix Capital B.V. in 2012. Sophie holds a PhD in Statistics from the University of Kassel (Germany) and is a Chartered Financial Analyst (CFA). She grew up in France next to Auxerre and Chablis.